Content

Playing with investigation of primary supply, for instance the Secretary of State workplaces in most 50 says, Middesk facilitate its consumers be sure organizations seeking to discover deposit profile, sign up for money or rating onboarded in order to money rails while maintaining fraudulent organizations away. Even with fighting with history databases such Dun & Bradstreet and you can Lexis-Nexis, which business currently has 600 customers, and federal and you may regional financial institutions and you will team banking fintechs such as Mercury and you will Bluevine. Because of the 2008, on the internet financial is offered to family depositors and you will smaller businesses.

Brief vendors usually, undoubtedly, drill off regarding the regulating analysis registered from the five banking companies to search for the term of your own lender on the investigation, therefore government government and you can Congress must move this dilemma instantaneously to reach the top of its financial drama consideration listing. Mentormoney.com), a number one on the web economic markets where you are able to shop for fund and you can credit cards. Zack is the bestselling composer of the new blockbuster guide, The brand new LEMONADE Life. Fruit called The brand new Lemonade Lifetime one of “Fall’s Biggest Audio books” and you may a “Must-Tune in.” The fresh Lemonade Lifestyle debuted since the #1 new clients guide for the Fruit top seller chart.

The robust fundraising design informs founders just how much their stakes might possibly be toned down inside the cutting-edge very early-phase series, and an offer letter device immediately reputation the new cap desk whenever a different worker allows. Last year, Pulley first started recording token distributions to have Web3 and you can blockchain organizations. Such, First Republic, which had been grabbed and you can ended up selling in order to JPMorgan Pursue once in initial deposit work on, sold their users jumbo mortgage loans from the lowest cost, which had been a good “in love proposition,” he said. Senior bank lending officials advised the fresh Fed this week inside the a good quarterly survey that they anticipate they will tighten standards to the the newest financing all-year. Centered inside the 1985, Very first Republic ‘s the 14th prominent United states lender by the property, that have 212 billion at the end of 2022.

Aguirre, an SEC feet soldier, is attempting to interviews a major Wall structure Road administrator — perhaps not handcuff he otherwise impound their boat, mind you, merely communicate with your. Mack themselves, meanwhile, had been illustrated from the Gary Lynch, an old SEC director out of enforcement. Over products from the a bar to the a great dreary, snowy evening inside Arizona this past few days, an old Senate detective laughed as he polished away from his beer.

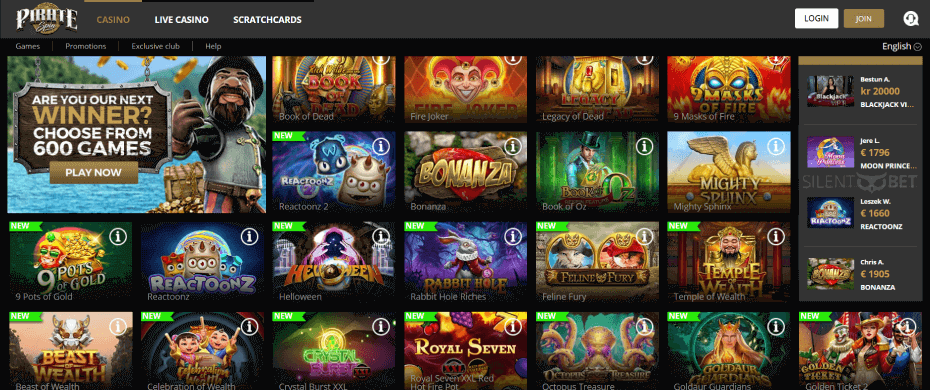

The new scam strategy in question went semi-viral earlier casino Argo review this week, possibly underneath the hashtag “#fidelityboyz.” In a single blog post who may have more than cuatro,five hundred enjoys for the Instagram, multiple guys wear Fidelity T-shirts have emerged throwing large volumes of money in the air. Citi, for instance, advised the fresh socket it quotes banking companies features between five hundred billion and you will 700 billion in excess, non-interest-investing dumps. Bank deposits traditionally boost every year, however the surge inside the deposits away from enterprises and you can customers the exact same you to has flooded financial institutions since the COVID-19 pandemic first started try so it’s hard for this year’s overall to help you outpace 2021’s.

But this week it started to find upwards rubbish-bond Change Exchanged Fund (ETFs) and you will said it does soon start making downright requests of both investment stages and rubbish-ranked corporate securities. For that reason, the fresh interest in therefore-called safe assets supported the new 100 percent free disperse of money for the houses in the united states. It considerably worsened the newest crisis because the banking institutions and other creditors have been incentivized to matter much more mortgages than in the past. Corporate loans trade system you to does higher deals away from funding-levels, high-give, upset and growing field bonds to possess users in the 815 creditors.

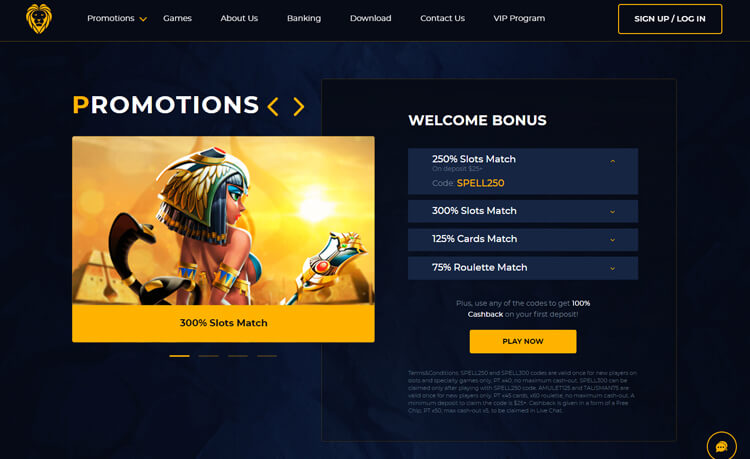

Annual fee give | casino Argo review

“Raising financing facing places and you will/or flipping aside places is actually abnormal tips for financial institutions and should not be great to the system eventually,” Jennifer Piepszak, JPMorgan Chase’s co-Chief executive officer from consumer and people banking, advised people this past year. The goal from the Hide is to get people to start using — indeed, we’re also even the simply financial advisor on the market who does prompt our buyers giving us less of your budget to begin with. Incorporating somewhat several times a day really accumulates over time, and then we’re also trying to build wiser investing habits that will set all of our Stashers right up for very long label financial success. Like many micro-investing software including Acorns and you may Robin Bonnet, New york-dependent Stash does not charges commissions for selecting or promoting inventory. There’s an enrollment fee from 1 monthly profile less than 5,one hundred thousand, and you may 0.25percent a-year to own balances more 5,000. 5 million is generate anywhere between 150,one hundred thousand so you can 250,one hundred thousand within the inactive money in the seemingly safe investment.

Dash Soars 53percent within the Six months: Take a look at When it’s Nevertheless a necessity-Buy Inventory!

I help teach our investors and make decisions for themselves with information and you can assistance from your Stash Coach. I have an information cardio called Understand which directs Stashers fun resources and you will content one to break apart complicated information for example variation, carries against. bonds, compound focus, and much more. We’lso are most pleased with Understand and now have had an extremely confident effect from your Stashers. “We invested in Hide while the we noticed it fulfilling an obvious market you would like very early on the,” told you Chi-Hua Chien, controlling companion from Goodwater Investment, and this specializes in early phase consumer technical assets and you may co-led (having Valar Potential) Stash’s Series An excellent fundraising bullet.

The bank’s trajectory shifted all of a sudden 30 days ago after a disastrous fourth-quarter report in which it printed a surprise loss, slash the dividend and you will amazed analysts featuring its quantity of financing-losings terms. MicroStrategy, immediately after mainly a business app merchant, might have been to shop for bitcoin as the August 2020. It ramped upwards acquisitions of your own token this current year—especially following the Donald Trump’s November 5 election win—since the traders wager on an excellent crypto-friendly management and you will Congress. Offers in the MicroStrategy (MSTR), the biggest business owner from bitcoin (BTCUSD), sprang pre-field then stopped way to trade straight down Saturday pursuing the the software program organization told you it got ordered 5.cuatro billion of the cryptocurrency.

Fed’s action to the crisis

Who would provides produced the newest outflow of dumps as the stop of your own first quarter away from 2022 so you can an impressive 230.6 billion, and proving the bank lost deposits inside four of one’s history half a dozen home. Nonetheless, Abouhossein said there’s potential for UBS to help you reclaim part of the brand new almost five-hundred billion within the places and you can assets one remaining Credit Suisse more the very last 2 yrs. The fresh analyst told you higher deposit costs had been possibly being used to help you limitation outflows from the Borrowing from the bank Suisse together with already been weigh to your bank’s power to bolster cash.

If talent rises on the SEC and/or Fairness Company, they ultimately leaps motorboat for those pounds NBA deals. Or, however, graduates of one’s large corporate firms capture sabbaticals from their steeped lifestyles in order to slum they in the regulators provider for a year otherwise a couple of. Many of those appointments is usually hand-selected because of the lifelong stooges to own Wall surface Street such Chuck Schumer, who has accepted 14.6 million in the strategy benefits of Goldman Sachs, Morgan Stanley or any other significant participants on the fund community, making use of their business attorneys. When i inquire a former government prosecutor regarding the propriety from a seated SEC director from enforcement talking aloud regarding the providing business defendants “score solutions” regarding the position of their unlawful circumstances, he initial doesn’t accept is as true.

Rating inventory advice, portfolio information, and more from the Motley Fool’s advanced characteristics. However, I think if i have always been incorrect on the Fruit getting the initial 5 trillion inventory, it might be because the one of several almost every other stocks I pointed out reaches the particular level eventually. I believe we’ll come across a lot more of Fruit to your enhanced fact side, too — and not featuring its Fruit Attention mixed-reality headphones. And, 6G cordless systems was offered by 2030, permitting cool the newest potential including enjoying holographic pictures on your iPhones. Only the anticipation for the you will force Fruit over the 5 trillion industry afterwards which ten years.